The 10 Best Private Equity Career Coaches Guide (2025): How Experts Help You Land Top PE Roles

Discover the top 10 private equity career coaches of 2025. Learn how expert coaching helps you land roles at leading PE firms.

Posted November 4, 2025

Join a free event

Learn from top coaches and industry experts in live, interactive sessions you can join for free.

Table of Contents

Breaking into private equity is one of the most competitive career goals in finance. From investment banking analysts preparing for on-cycle recruiting to consultants exploring growth equity or corporate finance roles, the process demands precision and preparation.

Between networking with headhunters, mastering technical interviews, and standing out in case studies and superdays, a lot is riding on your preparation. That’s where working with a private equity coach can be a game-changer. Personalized, expert guidance is one of the clearest ways to gain a real edge in landing the fund, role, and long-term career you want.

In this article, we handpicked this list based on each coach’s industry experience, client outcomes, coaching style, and depth of insight across resume prep, technicals, and interview strategy.

"I can’t recommend Kenny highly enough as a career coach and private equity professional. His deep industry knowledge and strategic insights were instrumental in helping me break into private equity and he has continued to be a resource as I navigate career decisions. Kenny’s personalized approach made a tremendous difference; he took the time to understand my goals and offered actionable advice that was both motivating and practical. Working with Kenny has been a game-changer and his mentorship has paid dividends for my career."

- Coached by Kenny, landed a role at Platinum Equity

"Akaash was essential to my educational and professional development during our time at university. He was instrumental in helping me determine my path toward Investment Banking and the Buyside, and even more instrumental in enabling me to achieve those goals at Lazard and Blackstone. He is an excellent coach with an incredible mind and abundant patience, and I hope he is given the platform to coach and help more people."

- Coached by Akaash, landed a role at Blackstone

Whether you’re recruiting from a non-target, aiming for a megafund, or trying to land your first buyside role, there’s a PE coach here who’s been in your shoes and knows how to help you succeed.

Why a Private Equity Career Coach Can Make All the Difference

Landing a role at a top firm is tough, openings fill fast, and interviewers expect precision, confidence, and clear judgment from the start. A skilled career coach helps manage every stage of preparation, bridging the gap between knowledge and real-world performance. Unlike banking programs that offer structured training, firms here expect you to hit the ground running. That’s where a coach makes a real difference, giving you practical frameworks, mock interviews, and game plans that mirror the real recruiting process so you can show up prepared and confident.

| Coach | Client Rating | Number of Satisfied Clients | Leland Outcome Score | Helped Clients Get Into… |

|---|---|---|---|---|

| Asha T. | ⭐⭐⭐⭐⭐ | 200+ | 9.9 | KKR, Bain Capital, TPG, Blackstone, Jefferies, The Carlyle Group, Morgan Stanley, SoftBank Vision Fund + more |

| Max M. | ⭐⭐⭐⭐⭐ | 300+ | 9.9 | Blackstone, HarbourVest, Bain Capital, Accel-KKR, Jefferies + more |

| Isha A. | ⭐⭐⭐⭐⭐ | 100+ | 9.9 | Jane Street, Brookfield, HIG, Blackstone, L Catterton, The Carlyle Group, KKR, TPG, Warburg Pincus + more |

| Akaash P. | ⭐⭐⭐⭐⭐ | 70+ | 9.8 | Gauge Capital, Evercore, Moelis & Co., Credit Suisse, Citigroup, Morgan Stanley, Goldman Sachs + more |

| Kenny J. | ⭐⭐⭐⭐⭐ | Unlisted | 9.6 | Blackstone, Platinum Equity |

| Wyatt S. | ⭐⭐⭐⭐⭐ | Unlisted | 9.7 | AVALT, Cinven, CD&R |

| Blake M. | ⭐⭐⭐⭐⭐ | 100+ | 9.9 | TZP Group, CD&R, AVALT, Comvest Partners, Sentinel Capital Partners |

| Julia M. | ⭐⭐⭐⭐⭐ | 200+ | 9.7 | KKR & Co., The Carlyle Group |

| Michael P. | ⭐⭐⭐⭐⭐ | 20+ | 9.6 | Warburg Pincus, Blackstone, General Atlantic |

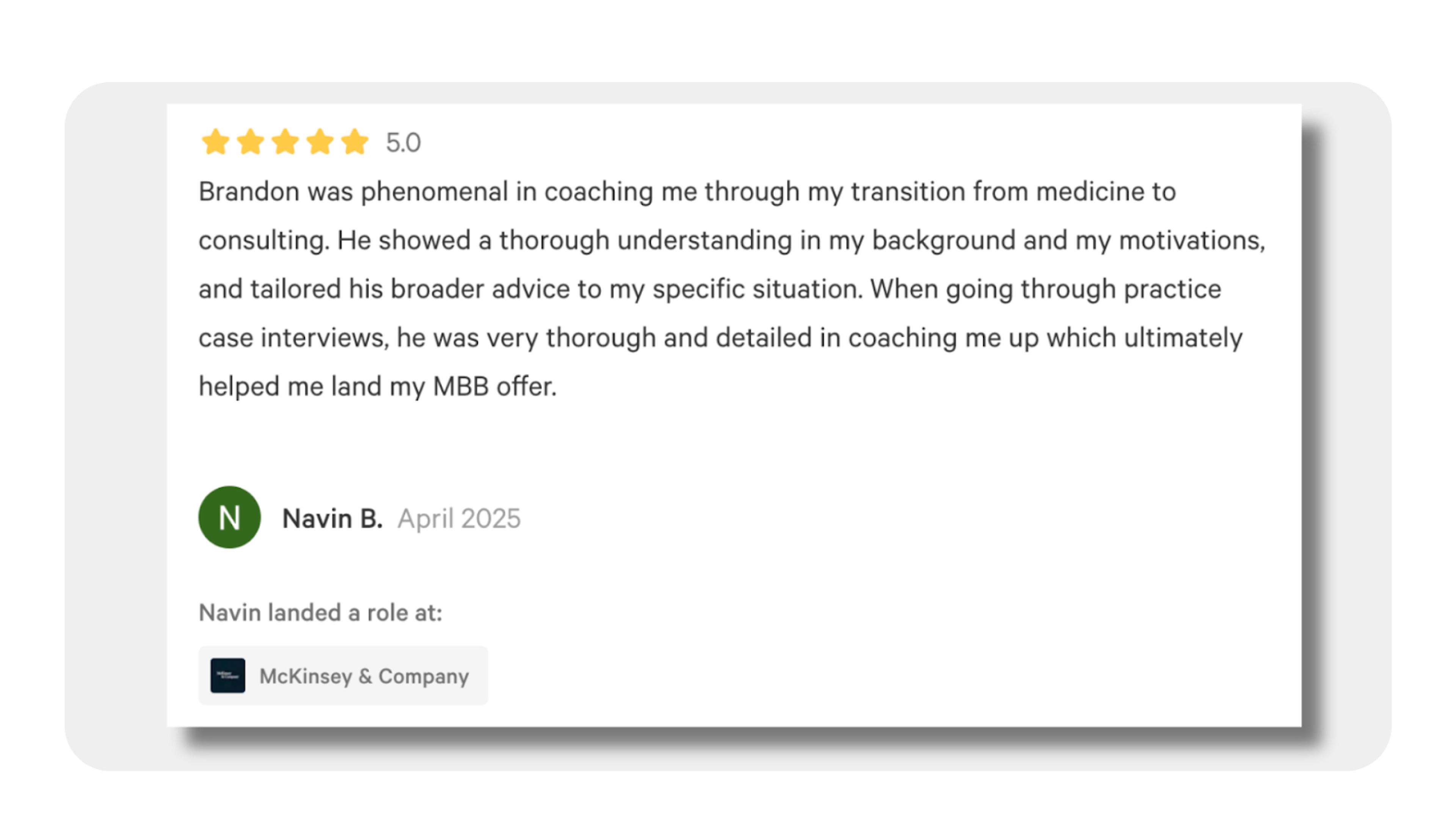

| Brandon W. | ⭐⭐⭐⭐⭐ | 10+ | 9.6 | Bain & Company, McKinsey & Company, Peloton Consulting Group |

Top 10 Coaches for Landing Offers at Private Equity Firms

Here are 10 of the best PE coaches in the country, each with a proven track record of helping candidates land roles at top-tier firms. From ex-investors at KKR, Warburg Pincus, and THL to Goldman Sachs and McKinsey alums turned elite coaches, these experts bring a rare mix of firsthand deal experience, recruiting insight, and personalized strategy. Whether you’re coming from investment banking, consulting, straight out of undergraduate/graduate school, or a non-traditional path, there is a coach on this list who can help you.

They’ve coached hundreds of professionals through every stage of the process – from crafting a compelling story and networking with headhunters to mastering technicals, acing case interviews, and negotiating offers at funds like Blackstone, Carlyle, Bain Capital, and more.

Asha T.

Harvard MBA | Ex-Apax Hiring Manager | Ex-J.P. Morgan & Deutsche Bank With Offers From Goldman Sachs, Morgan Stanley, Barclays, & Credit Suisse | 185+ Successful Clients

Asha A. is one of the most experienced and results-driven coaches on Leland. A Harvard Business School grad with 12+ years of experience across investment banking, private equity, and venture capital. She’s helped over hundreds of clients get offers from Blackstone, Bain Capital, KKR, Apax, HIG, Vista, Thoma Bravo, and many other top private equity funds.

Asha previously worked as a Senior Associate at Apax Partners ($60B AUM), where she evaluated and interviewed applicants herself, recruiting and interviewing for analyst and associate roles across New York and London, meaning she has insider expertise on what actually makes a candidate’s resume, interview, and case study stand out.

What sets Asha apart is the level of customization and access she offers: flexible scheduling for urgent prep, detailed session planning, and real-time insight into the headhunter landscape. She's known for extensively prepping and tailoring sessions to make them as productive as possible. Whether you're preparing for technicals, fine-tuning your resume, or navigating the cultural fit at U.S. vs. European funds, Asha’s approach can help put you in the top 1% of candidates.

Ideal for: Candidates targeting top private equity roles, those looking for high-touch, expert-level coaching across finance recruiting

Book a free intro call with Asha →

Max M.

Ex-THL Associate | Former Investment Banking at Goldman Sachs & Stifel | Wharton MBA | 300+ Mentored | Private Equity Course Creator

Max M. is one of the most dynamic and in-demand private equity coaches on Leland, known for his clear frameworks, deep recruiting insight, and genuine investment in his clients’ success. A former associate at Thomas H. Lee Partners (THL) and senior associate at Banyan Square Partners, Max successfully recruited into top-tier private equity roles after starting in Goldman Sachs’ TMT investment banking group.

Max has helped students and professionals land roles at firms like Blackstone, Bain Capital, Evercore, Moelis, HarbourVest, and Ardian. His clients benefit from tailored prep across every stage of recruiting, from resume refinement and behavioral drills to technical modeling and case interview walkthroughs.

Now a Wharton MBA, Max is also the creator of a comprehensive private equity recruiting course that demystifies the process from start to finish. His coaching is structured yet supportive, especially for candidates navigating competitive lateral or post-banking transitions.

With a background that spans public and private equity, hedge funds, and investment banking, Max brings an unusually holistic lens to the coaching process. He’s passionate about simplifying complexities, amplifying confidence, and helping driven candidates break into high-profile, high-impact roles.

Ideal for: Analysts and associates recruiting for PE or HF roles, candidates transitioning from being investment banking analysts or consultants, and those who want a proven structure and actionable feedback

Book a free intro call with Max →

Isha A.

KKR Out of Undergrad, Offers From Alpine, ICV, BlackRock, and Blackstone | $3B+ in PE Deals | 100+ Coached into Top Funds | Non-Target & International Applicant Specialist

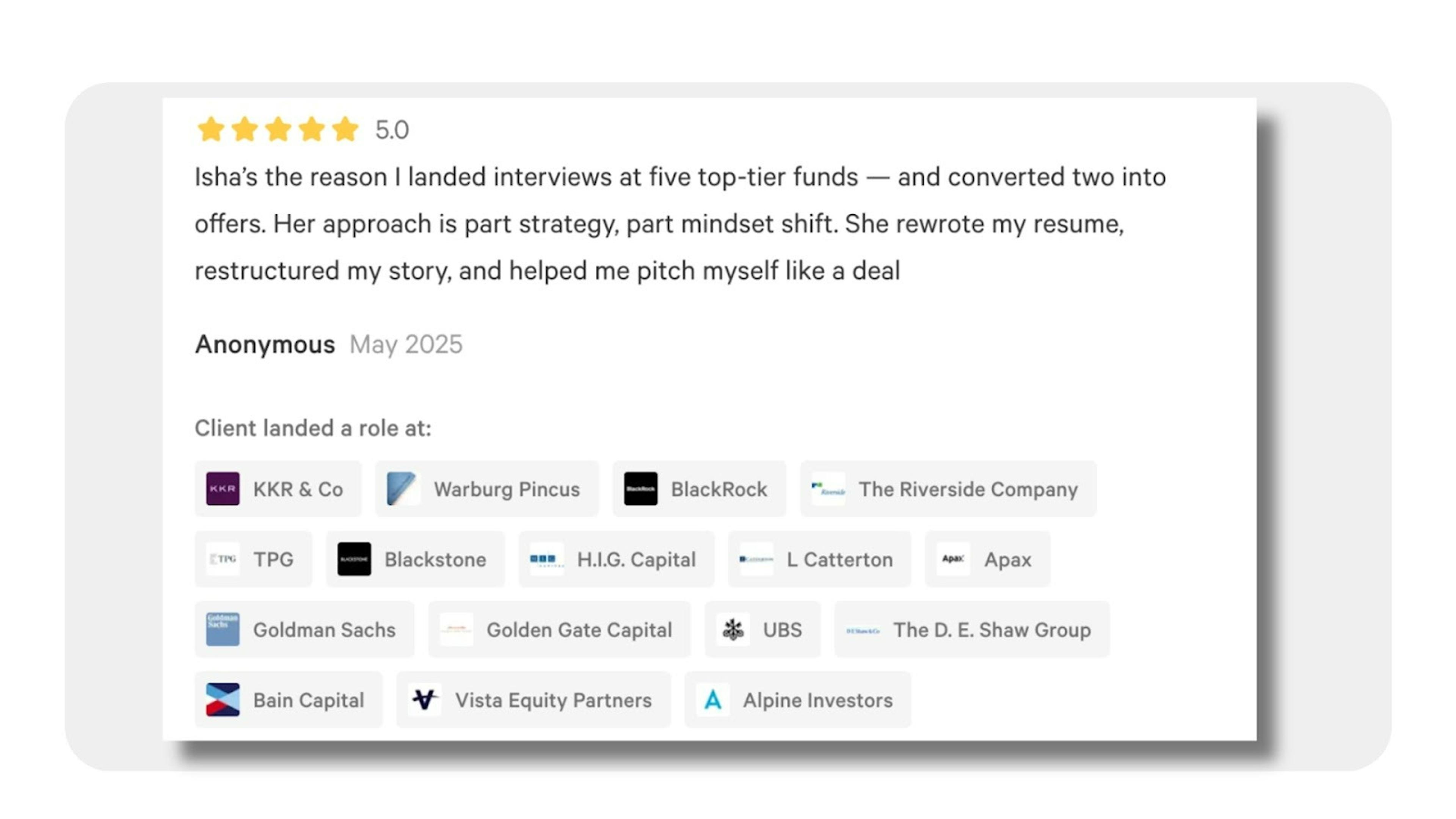

Isha A. broke into PE at 19, landed an investment banking job offer mid-flight, and joined KKR straight out of undergrad. Since then, she’s led ~$3B in deals across buyout, growth, and venture, working directly with founders, CEOs, and billion-dollar funds. She knows how to navigate high-stakes, prestige-driven environments with confidence.

Coaching for private equity, Isha has helped candidates land roles at top private equity funds like Blackstone, Carlyle, Advent, Bain Capital, H.I.G., and Vista Equity Partners, as well as major players in banking, consulting, and hedge funds. She coaches students and professionals with a sharp focus on helping non-target, underrepresented, and international candidates stand out.

Her approach is no-nonsense and high-impact: she’ll help you sharpen your narrative, master technicals, and build a strategy that aligns with your background and goals. With firsthand knowledge of the recruiting processes at 50+ top funds across the U.S., U.K., and Asia, Isha knows how to get you in the room, and how to help you crush the interview once you’re there.

Ideal for: Non-target or international candidates, women in finance, undergrads and early-career professionals aiming for top-tier PE roles, those seeking insider private equity insights.

Book a free intro call with Isha →

Akaash P.

PE + IB Pro | $600M+ in Closed Deals | 40+ Coached | Director of Corp Dev. | Ex-Lazard & Growth Equity

Akaash A. is a private equity coach with a rare mix of hands-on deal experience and strategic career insight. With a background that includes investment banking at Lazard and an early investment team role at a $500M PE fund, he’s now a Director of Corporate Development driving M&A at a high-growth physician practice management roll-up.

He’s coached dozens of clients into firms like Blackstone, Moelis, Centerview, Jefferies, Houlihan Lokey, and more, helping them master the full recruiting process: resume strategy, interview prep, technicals, and offer negotiation. His clients range from undergrads aiming for their first PE role to working professionals looking to lateral or level up.

What sets Akaash apart is his tactical, grounded approach. He’s executed over $600M in M&A and PE deals, so he doesn’t just know the questions you’ll be asked; he’s lived the deals behind them. Whether you’re breaking into private equity or looking to accelerate your career, Akaash delivers sharp, actionable coaching that gets results.

Ideal for: IB analysts and early-career professionals breaking into PE, lateral candidates, or aspiring corp dev leads

Book a free intro call with Akaash →

Kenny J.

Private Equity Investor | KKR & Co. | Founding Member at Unreasonable Collective | Former Blackstone Associate

Kenny J. brings a wealth of experience in private equity and investment management. Currently a Private Equity Investor at KKR, Kenny has also been a Founding Member of Unreasonable Collective, an exclusive global investor club focusing on high-impact investments. Prior to his role at KKR, Kenny spent four years at The Blackstone Group, where he honed his expertise in private equity investments and impact investing.

Kenny’s experience in top-tier private equity firms and impact-driven investment groups allows him to offer unmatched guidance to candidates aiming to break into private equity, particularly those transitioning from investment banking, consulting, or undergraduate programs. With offers from leading firms like TPG under his belt, Kenny is especially adept at coaching those from non-target schools or non-traditional backgrounds, offering strategies for navigating tough recruitment processes and tailoring applications for firms that emphasize both financial acumen and social impact.

Ideal for: Candidates seeking a grounded and strategic approach to breaking into private equity from consulting, non-IB backgrounds, or undergrad programs. Whether you’re targeting major firms like KKR or boutique funds, Kenny’s coaching is tailored to help you make confident strides toward your private equity career.

Book a free intro call with Kenny →

Wyatt S.

Ex-McKinsey | Vice President at AVALT (Bain Capital Spin-Off) | Fund Founder | Non-Target to Buyside

Wyatt S. brings deep lived experience to private equity coaching. After breaking into McKinsey as a non-target undergrad, he rose to Vice President at AVALT, a $1B middle-market fund founded by Bain Capital alums. He’s now launching his own fund and coaching to help others navigate the same high-bar transitions.

Wyatt is especially effective with candidates coming from consulting or non-IB backgrounds. Having directly interviewed candidates at AVALT and moved up without an MBA, he offers tailored support for roles at “consultant-friendly” funds like Golden Gate, Serent, and CD&R. He understands the emotional and strategic hurdles of pivoting into the industry after loss, risk, or career change, and coaches with a clear, grounded presence that reflects those experiences.

Whether you're targeting PE from consulting or aiming for it after undergrad, Wyatt can help you make the leap with confidence.

Ideal for: Consultants targeting PE, non-target applicants, candidates seeking mentor-style coaching

Book a free intro call with Wyatt →

Blake M.

Former VP at HIG Capital | Led Recruiting at 3 PE Firms | 10+ Years in Finance & Wharton MBA | Recruiting & Interview Expert

Blake M. brings a decade of firsthand experience in PE and investment banking, plus deep inside knowledge from running recruiting at three different firms. As a Vice President at H.I.G. Capital’s flagship fund, he led interview prep, designed take-home case studies, and created grading rubrics for superdays. That makes him uniquely positioned to help you ace the process from the inside out.

Blake is a tactical, high-structure coach who equips candidates with curated frameworks, interview templates, and detailed prep plans. He’s coached 30+ professionals into firms like CD&R, Sentinel, and TZP Group, and previously taught PE interview strategy at Wharton’s PE/VC Club. He believes in the apprentice model of private equity, and coaches like a trusted peer who’s just a few steps ahead.

Ideal for: Mid-market and growth equity candidates, Boston-based applicants, anyone who wants sharp, structured, no-fluff prep, applicants struggling or looking to improve in the interviews

Book a free intro call with Blake →

Julia M.

Former Thoma Bravo Senior Associate | Ex-Lazard RX | 200+ Coached | Behavioral/Technical Interview Expert

Julia M. combines firsthand experience from top firms like Thoma Bravo and Lazard with years of coaching success to help candidates break into private equity. A former PE investor at Thoma Bravo and restructuring analyst at Lazard NYC, she’s been on both sides of the recruiting table. She’s helped clients land roles at KKR, Carlyle, Moelis, and more.

Julia brings a warm, structured approach to a process that often feels like a black box. She excels at helping candidates clarify their story, prepare for technical interviews, and navigate both on- and off-cycle recruiting with confidence. With deep empathy and a track record of success, she’ll help you stand out – not just on paper, but in the room.

Ideal for: IB analysts navigating on/off-cycle PE recruiting, candidates targeting top tech-focused funds, anyone who needs support on the fit interview or technical interview portion

Book a free intro call with Julia →

Michael P.

Principal at Warburg Pincus | HBS + Wharton | 15+ Years in PE | Author of Top Interview Guide| Hundreds of PE Candidates Interviewed

Michael P. brings over 15 years of front-line experience in global finance and currently serves as a Principal at Warburg Pincus, one of the most prestigious firms worldwide. A graduate of Wharton undergrad and Harvard Business School, Michael combines elite academic credentials with deep industry expertise across private equity, investment banking, and recruiting strategy.

He’s interviewed hundreds of candidates and mentored dozens of analysts and associates over the past decade, meaning he knows exactly what separates strong applicants from average ones. He’s also the author of the widely circulated “Comprehensive Finance Interview Guide,” a go-to prep resource for breaking into finance.

Michael offers targeted coaching across resume development, interview prep, technicals, and long-term career planning. Whether you're targeting top firms like Blackstone or General Atlantic or preparing for a post-IB pivot, his guidance is precise, practical, and grounded in real experience.

Ideal for: Candidates targeting elite PE roles, professionals prepping for on-cycle/off-cycle recruiting, long-term career strategists, aspiring investment professionals

Book a free intro call with Michael →

Brandon W.

Ex-Charlesbank PE Associate | Bain & Co. Alum | Wharton MBA | First-Gen & FGLI Advocate

Brandon W. blends elite private equity experience with a passion for mentorship and accessibility. As a former Associate at Charlesbank Capital Partners, he executed platform transactions and worked closely with portfolio companies across healthcare, business services, and consumer sectors. Before that, he was an Associate Consultant at Bain & Company in Atlanta, where he worked with both PE and corporate clients across multiple industries.

Now an MBA candidate in Wharton’s Health Care Management program, Brandon offers deep insights into PE recruiting, especially for candidates from non-traditional paths or geographies. He’s particularly supportive of first-generation and low-income students, and his coaching style is practical, empathetic, and grounded in real recruiting experience.

Whether you’re targeting private equity from consulting, banking, or undergrad, Brandon can help you refine your narrative, sharpen your technicals, and navigate the recruiting timeline with confidence.

Ideal for: FGLI and underrepresented students, non-NYC/SF/Chicago PE candidates, consulting-to-PE transitions, those seeking help with the private equity interview process

Book a free intro call with Brandon →

The Best Private Equity Training & Interview Prep

Choosing the right coach can be just as critical as choosing which private equity funds to target. The best coaches don’t just help you prep for interviews, they help you craft a standout narrative, navigate headhunters, and build a strategy tailored to your background and goals.

Start by thinking about what kind of support you need. Are you looking for resume and technical prep? Insider insight from someone who’s worked at your target fund? Strategic guidance on on-cycle vs. off-cycle recruiting? The right private equity coach will meet you where you are and bring clarity to a process that’s often opaque, compressed, and fiercely competitive.

How to Find the Right Private Equity Coach for Your Career Goals

When choosing a coach, prioritize deep industry knowledge, strategic alignment, and a track record of real results. Here’s what matters most:

- Industry Expertise: Seek out coaches with hands-on experience in private equity, investment banking, or top-tier finance roles, especially those who’ve worked at private equity firms you’re targeting (e.g., KKR, Blackstone, Bain Capital) or have insight into the recruiting process from the inside.

- Strategic Fit: The best coach will understand your background whether you're coming from a non-target school, consulting, or banking, and tailor their guidance accordingly. Great coaches know how to bridge your experience with the specific demands of PE recruiting.

- Proven Outcomes: Top coaches have helped candidates land roles at elite funds and bulge bracket banks. Look for a history of successful placements, strong client reviews, or leadership in finance prep programs.

- Recruiting Specialization: Some coaches are experts in on-cycle PE recruiting, others in growth equity, corp dev, or HF transitions. Match their strengths to your goals, especially if you’re navigating technical interviews, take-home cases, or headhunter strategy.

Note: Everyone’s path into PE is different. A strong coach will help you cut through the noise, build a standout application, and win offers from the funds where you’ll thrive.

Ready to Find the Right Private Equity Career Coach for You?

Breaking into private equity is one of the most competitive and high-stakes career moves in finance. But you don’t have to go it alone. The right private equity coach can help you clarify your narrative, master technicals, avoid recruiting pitfalls, and stand out at every stage of the process.

The PE coaches on this list bring serious firepower: from former investors at firms like KKR and Warburg Pincus to interviewers who’ve run recruiting at mid-market and mega funds. Whether you're recruiting from banking, consulting, or undergrad, there’s someone here who can give you the strategy, structure, and support you need to land the offer.

Ready to start? Book a free intro call to get matched with a coach by a Leland advisor. Still exploring? Browse private equity coach profiles and client reviews to find the best fit for your goals.

Read:

- The Different Types of Buy-Side Firms–and How to Choose One

- The Best Venture Capital & Private Equity Newsletters and Podcasts

- Top Skills You Need to Break Into Private Equity

- Private Equity Interviews: The Ultimate Guide

- The 5 Most Prestigious Private Equity Firms

FAQs

Is a career in private equity worth it?

- Yes, a career in private equity can be highly rewarding, offering top-tier compensation, rapid career growth, and the opportunity to be involved in high-stakes private equity investments. It provides exposure to deal structuring, value creation, and portfolio companies, making it ideal for those who excel under pressure and are driven by achieving financial returns. However, it is also demanding and competitive, requiring candidates to demonstrate strong investment banking or consulting backgrounds.

What is private equity training?

- Private equity training includes structured programs, online courses, or 1:1 coaching sessions that prepare you for both the interview process and the day-to-day work in private equity firms. Training typically covers key areas such as LBO modeling, valuation, deal structuring, and due diligence. It may also include practical exercises related to real private equity deals, helping you gain the practical skills required to succeed in this highly competitive field.

How hard is it to study for PE interviews?

- Preparing for private equity interviews is challenging, especially for those without direct experience in investment banking or private equity. You’ll need to be proficient in LBO modeling, valuation, and financial modeling, while also being prepared for market sizing and deal logic questions. Many candidates spend 4-8 weeks preparing, and hiring a private equity career coach can greatly enhance your prep by providing personalized insights into the private equity interview process.

What should I know for a PE analyst interview?

- For a private equity analyst interview, you should be able to build and explain an LBO model, discuss past deals, and evaluate investment opportunities. Private equity firms are looking for candidates with strong analytical skills, investment judgment, and communication skills. It’s crucial to demonstrate that you can contribute to value creation within portfolio companies and understand the private equity investment process.

How do I prepare for a career in private equity?

- To prepare for a career in private equity, start by building a solid foundation in finance, ideally through investment banking or consulting. Focus on mastering LBO modeling, understanding capital structure, and developing an investor’s mindset. Networking with private equity professionals and leveraging private equity coaching can give you an edge in navigating the complex private equity interview process. Gaining private equity insights and learning about private equity clients is also essential for making informed investment decisions.

What is the best private equity course?

- The best private equity course depends on your specific needs. For interview preparation, Wall Street Prep, Training the Street, and Leland’s PE Bootcamp are excellent options, offering hands-on training in LBO modeling, deal structuring, and case-based exercises. 1:1 coaching sessions with experienced professionals can also help refine your financial modeling and due diligence skills, simulating real private equity deals.

Is the CFA worth it for private equity?

- While the CFA is a respected qualification in finance, it is not typically required for a career in private equity. Private equity firms prioritize deal experience, financial modeling skills, and a strong investing mindset over the CFA designation. However, the CFA can be valuable later in your career, particularly for those transitioning into roles that require deep financial analysis or looking to move between asset management industries.

What are the best private equity firms to work for?

- The best private equity firms to work for typically offer a combination of competitive compensation, strong career development opportunities, and an engaging firm culture. Top firms like Blackstone, KKR, and The Carlyle Group are known for their prestige, fund performance, and global reach. Middle-market private equity firms like Summit Partners and Genstar Capital offer a more collaborative environment and early responsibility in deal execution and portfolio management.

Is middle-market private equity worth it?

- Middle market private equity is an attractive career path for those looking for greater responsibility, faster career progression, and a hands-on role in value creation. While compensation may be slightly lower compared to mega-funds, middle-market firms often provide opportunities for more involvement in deal structuring, growth equity, and post-investment operations, making it a rewarding long-term option for professionals.

What is the difference between venture capital and private equity?

- The primary difference between venture capital (VC) and private equity (PE) lies in the stage and risk profile of the companies they invest in. Venture capital firms invest in early-stage, high-growth companies, typically in venture capital firms focused on startups, while private equity firms typically target more mature, established companies. Private equity focuses on value creation through operational improvements, cost reduction, and financial engineering, often through leveraged buyouts (LBOs).

What are the four types of value creation in private equity?

- The four main types of value creation in private equity are:

- Operational improvements- increasing efficiency and reducing costs;

- Multiple expansion- exiting investments at higher valuations;

- Revenue growth- achieving organic growth or through acquisitions;

- Leverage optimization- using debt effectively to amplify returns while managing risk.

- These strategies are central to driving returns for private equity clients and generating profit for private equity firms.

Which private equity firms are public?

- Some major private equity firms are publicly traded, including Blackstone, KKR, The Carlyle Group, and Apollo Global Management. These firms offer shares in their asset management business, allowing them to access permanent capital while managing traditional private equity funds. Being publicly listed provides transparency and liquidity, while these firms continue to focus on private equity investments and fund performance.

Is leveraged finance the same as private equity?

- Leveraged finance and private equity are related but distinct fields. Leveraged finance involves structuring high-yield debt and leveraged loans used to fund private equity investments or buyouts. While private equity firms use this debt to acquire companies, leveraged finance professionals focus on managing the issuance and structuring of such financial products. The two fields intersect, but private equity professionals are more involved in the entire investment lifecycle, from sourcing deals to managing portfolio companies.

What is the LBO model of private equity?

- The LBO model (Leveraged Buyout) is a fundamental technique in private equity, where a firm acquires a company using a combination of debt and equity. The debt is secured against the company’s assets and cash flow, amplifying the returns on equity. After acquiring the company, the goal is to improve company performance, reduce debt, and eventually exit at a higher valuation, generating value creation and high returns for both the private equity firm and its clients.

Who are the clients in private equity?

- Private equity clients typically include institutional investors like pension funds, endowments, and insurance companies, along with high-net-worth individuals (HNWI), family offices, and sometimes corporate investors. These clients provide capital to private equity firms in exchange for high returns through private equity investments in private companies. They invest in portfolio companies to drive growth equity and generate returns by leveraging strategies such as value creation and deal structuring.