Leland+ for Hedge Fund

Popular on Leland+

Drivers of Value Creation & Valuation: Insights for Hedge Fund Investors

In this foundational session, you’ll explore the key levers of business value creation—understanding how revenue dynamics, margin improvement, capital efficiency, and growth initiatives shape valuation. By grounding yourself in these fundamental concepts, you’ll establish the strategic foundation you need for identifying critical inflection points and alpha-generating opportunities in later deep-dive sessions. Guiding you through it is Leland coach Diyang Y., who brings first-hand experience from M&A at RBC and as a long/short equity analyst at Point72. He emphasizes that success in investing isn’t just technical—it’s about “thinking independently, building conviction in an idea, and communicating it clearly under pressure.” This session will offer not just conceptual clarity but practical tools to sharpen your analytical mindset and valuation approach.

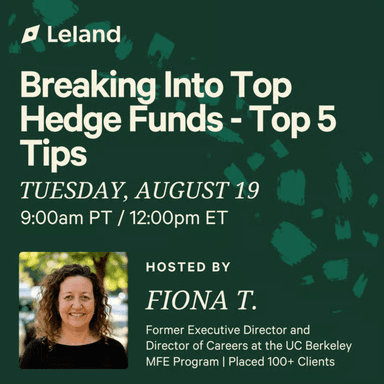

Breaking Into Top Hedge Funds - Top 5 Tips

Curious how to break into the highly competitive world of Hedge Funds? Whether you’re coming from a technical background, transitioning from another industry, or currently pursuing a degree in finance, data science, computer science, or mathematics, this session is your insider guide. Learn from Fiona T., former Executive Director of the UC Berkeley Haas MFE program. Fiona will share with you tips on breaking into Hedge Funds and strategies on your resume, LinkedIn profile, Networking and more! In this focused workshop, you'll uncover the Top 5 proven strategies to position yourself for roles on the buy-side at Hedge Funds. Learn what recruiters really look for, how to showcase your technical strengths, and how to avoid the most common mistakes applicants make when targeting top-tier Hedge Funds!

LPRO Case Study: An Investment Thesis

A deep dive into the Open Lending Corporation (LPRO) case study. Learn to build a compelling investment thesis from a bull and bear perspective and defend your final recommendation.