Leland+ for Investment Banking

Popular on Leland+

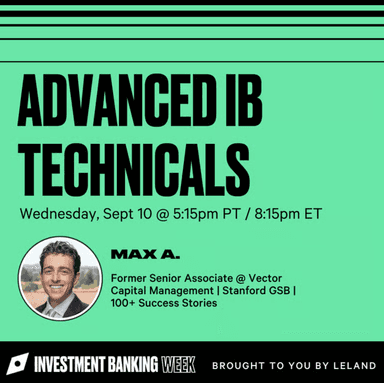

Advanced IB Technicals

Are you ready to tackle the toughest technical questions in investment banking and private equity interviews? Join expert Leland coach, Max A., for an Advanced IB Technicals session. Whether you're a student, in the industry, or just trying to sharpen your technicals, come ready to discuss LBOs, NOLs, bond yields, and more. With over five years of experience mentoring 250+ aspiring finance professionals, Max has honed a deep understanding of what top banks and PE firms are looking for. His background includes roles at elite firms like Lazard, Qatalyst Partners, and Vector Capital Management, and he's currently pursuing an MBA at Stanford GSB and an MPA at Harvard Kennedy School. In this session, you'll dive into technical interview prep, mergers and acquisitions, and essential skill-building to ensure you're ready for anything. Whether you've stumbled on a technical question before or just want to sharpen your edge, this event is for you.

Top 5 Tips to Get Into IB

Are you looking to break into investment banking as your next career move? Join Alejandro A., a seasoned investment banking and private equity professional, for an exclusive session where he will share essential strategies to help you stand out in the highly competitive recruiting process. With over 10 years of experience, Alejandro has worked at prestigious firms like Goldman Sachs, where he served as an Investment Banking Associate, and at Fanatics, as Director of M&A. He also co-founded Harbor Street Capital, a private equity fund, and has mentored over 200 students who have gone on to secure positions at top firms such as Goldman Sachs, Evercore, JPMorgan, and Morgan Stanley. In this event, Alejandro will provide insider insights into how to successfully navigate the investment banking recruitment process and stand out as a top candidate.

Introduction to LBO Modeling - Mini

This is a great introductory model to LBO analysis and if you need to do a quick and simple LBO model to see how the math works out.

Investment Banking Week (September 8-11) Kickoff

Join us for Leland's Investment Banking Week (September 8–11) Kickoff! Come hear from top IB experts Katharine J, Jonathan H, and Isha A. who have helped candidates break into leading Wall Street firms and excel in their roles.

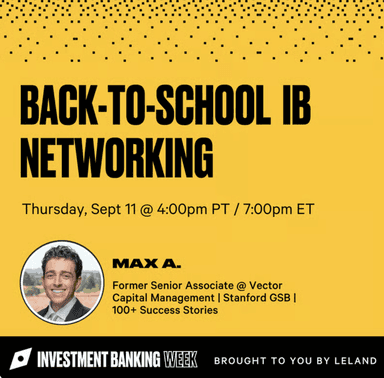

Back-to-School IB Networking

Kick off the recruiting season with Max A. (Former Senior Associate @ Vector Capital Management) in this interactive networking-focused session for students interested in private equity and investment banking. Whether you're preparing for fall interviews or just getting started in the process, this workshop will help you build key relationships, ask the right questions, and make a strong impression. Max will share tactical tips on how to connect with professionals and stand out in coffee chats and info sessions—just in time for the start of the school year.

The Perfect Finance Resume Template

The go to resume template to ace the initial screening process and land an IB or PE role.

Advanced 3 Statement DCF LBO Case Study

If you are an Investment Banking Associate lateral hire, this downloadable resource should help you cover all the preparation you need for your interview case study

Introduction to LBO and DCF Combined Modeling

This is the only model you need to build out a combined DCF and LBO valuation analysis.

Introduction to LBO Modeling - Full

This is the only model you need to build out a full LBO model.

Breaking In and Breaking Through: IB Crash Course for International MBA Associates

Designed specifically for international MBA students targeting Investment Banking roles in the US, this hands-on bootcamp demystifies the IB recruiting process and sets you up for success from networking to technicals. The session is led by Yudhajit D., a former IB associate and TTS trainer, and focuses on high-leverage areas that international candidates must master early: Storytelling & Behavioral Mastery for non-US backgrounds Technical Prep That Works Under Pressure Navigating Work Authorization & Visa Concerns Confidently What Top Banks Really Look for in International Candidates Yudhajit will use real examples, interactive exercises, and common recruiting pitfalls to help you confidently position yourself as a competitive IB candidate from Day 1 of recruiting.

Navigating International IB Recruiting: US & Beyond

Breaking into Investment Banking as an international MBA isn’t just about technical prep—it’s about strategy. Visa hurdles, shifting timelines, and uncertainty in the US market often force candidates to explore global options. This session is designed for international MBAs who want a structured roadmap to maximize their odds in the US—and build a contingency plan across London, Paris, Zurich, Singapore, and other major hubs. Drawing from firsthand experience and lessons from clients who’ve successfully made the jump, join Yudhajit D. as he covers what works, what doesn’t, and how to de-risk your recruiting journey.

Introduction to Financial Statement, Operating Revenue Build, and Credit Modeling

This is the only model you need to build out a generic three statement financial model with a corresponding operating revenue build, followed by a credit analysis.

Investment Banking Recruiting: Ask Me Anything

Breaking into investment banking is competitive and often overwhelming—but you don’t have to go through it alone. In this AMA, Max S. (current COO and ex Citi) will answer your questions about every stage of the IB recruiting process. From networking strategies and resume tips to technical prep, behavioral interviews, and navigating accelerated timelines, this is your chance to get unfiltered advice directly from someone who's successfully helped candidates land roles at leading Wall Street firms. Bring your questions and leave with actionable insights to make your recruiting journey more focused, efficient, and successful.

Introduction to Merger Model - Accretion Dilution Full

This is the only model you need to build out a full merger model - accretion dilution analysis.

How to Network Like a Pro to Land IB Interviews

In investment banking recruiting, networking often makes the difference between landing an interview and getting overlooked. But how do you build genuine connections without coming across as transactional? In this session, you’ll learn how to strategically approach bankers, craft outreach messages that get responses, and turn conversations into interview opportunities. We’ll also cover how to expand your network, manage follow-ups, and position yourself as a strong candidate throughout the process. Jonathan S., an experienced investment banker and Leland coach with a background at top firms, will share proven tactics and insider advice to help you stand out in one of the most competitive recruiting environments

Introduction to Financial Statement and DCF Modeling with Example Operating Revenue Builds

This is the only model you need to build out a generic three statement financial model with a discounted cash flow (DCF) model. It also includes sample operating revenue builds, specifically in the restaurant industry and in telecom.

Intermediate Practice LBO Model

This case is designed to train lateral analysts targeting roles at middle-market private equity and investment banking firms

Breaking into IB in London

In this session, Leland coach Vanessa L.—a former investment banker turned operator and investor—shares her insider perspective on breaking into Investment Banking in London. Having worked across M&A and capital markets at top firms in both NYC and London, she’s coached 40+ professionals through high-stakes transitions into IB and beyond. You’ll walk away with actionable strategies for refining your story, succeeding in interviews, and navigating the competitive London IBD landscape. Whether you're targeting analyst roles or looking to pivot into IB from another path, this session is designed to equip you with the confidence, clarity, and practical tools to advance your career with intention.

Example IB/PE Resume

See an example resume that's been used for a variety of finance roles. The resume background highlights finance degree at UT Austin and work experience at Evercore and I Squared Capital.

Introduction to Merger Model - Accretion Dilution Mini

This is an introductory model to Merger Model Analysis, also known as Accretion Dilution Model Analysis.