How a Disneyland Churro Helped Me Land a Job at Bain (and 5 Pitfalls to Avoid in Market Sizing Problems)

How a Disneyland churro led to acing the case interview which led to a job at Bain, from a current MBB consultant. Plus an overview of the five most common market sizing pitfalls to avoid.

By Wesley B.

Former Bain interviewer | Helped 30+ land MBB offers | Case Prep Expert

Posted June 13, 2025

Join a free event

Learn from top coaches and industry experts in live, interactive sessions you can join for free.

Table of Contents

Okay—I know what you’re thinking: “Disneyland churros are good and all, but are they that special?” And I would agree…they’re overpriced and too small. But, that’s a debate for another time. The real question is, “How many churros does Disneyland sell every year?” (Go ahead, try to ‘size’ the churro market!)

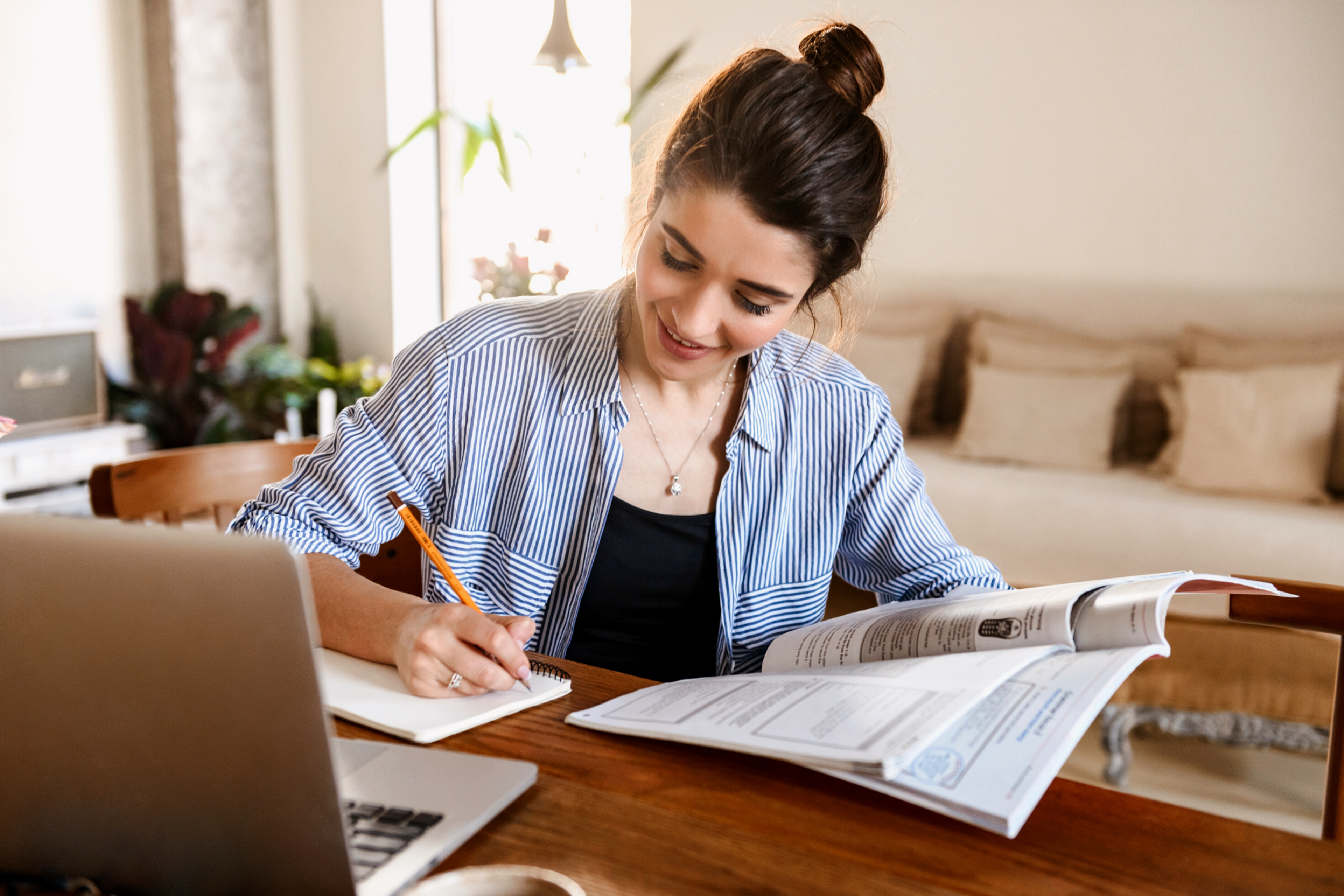

My name is Wesley B. and I’m a Management Consulting coach on Leland. I’ve helped dozens of my friends and peers land jobs at top consulting firms around the world. I’d love to help mentor you along the management consulting path! Below I’ve included some market sizing pitfalls to avoid that I hope you find helpful.

My Experience

This was the exact question I asked myself while sitting in an hour-long line watching dozens of people walk by with churros in their hands. Here’s how I broke down the math in my head:

# churros sold at Disneyland each year = # of people that attend per day * # of days open per year * % of people who buy a churro * Avg. # of churros each ‘buyer’ purchases.

I can’t remember the exact number I actually estimated (read: I was probably way off!), but breaking down the question into one big math formula made sense to me and was actually kind of fun (this is where my wife says “nerd alert!”).

At the time, I was preparing for management consulting cases and struggled with market sizing problems. However, from the moment I mentally structured the ‘Disneyland churros’ market, case interviewing began to click. The same foundational skills that helped me size the churro market were also the same skills that would help me size any market.

I made it a daily drill to ‘size the markets’ all around me:

- How many babies are born in Texas each year? (My wife and I were considering starting a family, and we were hoping to live in Texas)

- How many chicken nuggets does Chick-fil-a sell each day? (who doesn’t think about Chick-fil-a all day?)

- How many different baseballs are used in Major League Baseball games every season? (I’m a big baseball fan—Go Red Sox!)

For me, learning to excel in market sizing unlocked case interviews. I learned how to structure problems, utilize an 80/20 approach, ace my mental math skills, and communicate effectively. Not only is the Disneyland churro overpriced and delicious, but it was also the key to helping me learn critical market sizing skills and land a job at Bain.

Five Pitfalls to Avoid While Doing Market Sizing Problems

As I mentioned before, effective market sizing is an important way to show your interviewer that you know how to structure effectively, utilize an 80/20 approach, do mental math, and communicate well. Some worry so much about nailing the mental math that they neglect mastering other skills that can help land you a job! Here are some of the major pitfalls I see in case interviewees:

Pitfall #1 | Making implicit assumptions

Never assume. Never assume. Never assume. If you’re not sure, just ask! If you think you know, then ask to be sure. It is critical that you know exactly what market you’re trying to size.

For example, if I were to ask you to “size the mattress market,” how would you approach that problem? Well, it depends! Are we assessing the U.S. mattress market or the global mattress market? Do we want to know the number of mattresses sold or the dollar amounts of mattresses sold? Are we sizing the market by the end consumer spend or spending at the wholesale level? Honestly, the “goal” market the interviewer has in mind could potentially be a combination of any of those responses.

Before you start your structure, make sure that you are crystal clear on what you’re trying to size. The clarification alone will get you much closer to cracking the case. Plus, your effort to clarify will showcase your attention to detail and critical thinking skills and impress the interviewer almost as much as anything else.

Pitfall #2 | Segmenting at the wrong level of detail

Staying at a high-level versus digging deeper to find a more precise answer is a balancing act. If you stay at too high of a level, you may miss some of the nuances the interviewer is trying to test you on. If you dig too deep, you may complicate your own work and be at risk of “false precision.” Learning this balance is challenging, but mastering it is key to your success as a consultant. The interviewer is trying to test if you can get 80% of the way with 20% of the work (often referred to as the 80/20 approach).

It takes practice to master the 80/20 approach (even after you’ve been a consultant for several years), but here’s a quick tip for applying the 80/20 approach during market sizing:

Ask yourself: Will segmenting out this part of the formula get me to a better answer without causing me to lose time and accuracy? If the answer is a clear yes, then do it! However, if you feel that your segmentation may cost you too much time and/or accuracy, then think twice about it.

The balancing act occurs between the:

(1) The strength of your answer – How precise and strong is the overall answer?

(2) The time to answer – How much time will it take me to come up with the answer?

(3) The risk of accuracy – What is the likelihood of losing accuracy due to problem complications?

It may feel overwhelming, but the balance is learned with repetition and practice.

Pitfall #3 | Not communicating the math clearly

I’ve done market sizing cases with dozens of individuals over the phone. Those who are best at over-communicating clearly over the phone often do better during real, live interviews. Too many people dive into the numbers without fully aligning on the structure or formula.

Under-communicating could cost you the job for several reasons: Firstly, under-communicating often correlates with bad communication skills; secondly, it increases the likelihood of you missing key information to crack the case; and lastly, it does not enable the interviewer to redirect you early on in the case if you happen to make a mistake (which happens to all of us!).

Pitfall #4 | Not sharing the “so what” of your answer

At the end of every case, it’s critical to ask yourself, “So what?” In other words, “Why does this answer matter?” Sometimes it’s not obvious given the context of the problem, but do your best to put the answer into the bigger picture of the case. Understanding the relevance of problems will show the interviewer that you are thinking ahead and trying to drive the answer forward.

For example, let’s say you are helping the COO of a Fortune 500 company (with revenues well over $1B) size the market opportunity for an adjacent product because the company is looking to potentially enter the space. After successfully clarifying the market of the adjacent product, building a framework with the right level of segmentation, and communicating the math clearly, you come to the answer that the opportunity is only worth ~$3M.

What’s the “so what?” My first instinct is that the opportunity is not worth the COO’s time and risk. However, maybe the $3M market is expected to grow strongly over the next 5-10 years and the early entrance will turn into big returns. Obviously, there are several correct answers and follow-up questions here, so showing the case interviewer that you’re thinking through these topics and the next steps are key to your success as the interviewee.

Pitfall #5 | Not knowing where you could be wrong

Every time I would build a market model or come up with an answer during an actual due diligence assignment, my Senior Manager would ask me, “Where could we be wrong here?” or, “Would you bet your bonus on this answer?”

Market sizing is never 100% accurate. It’s often more important to know where you could be wrong and by how much than to be right.

Be confident in the answer you deliver but be humble enough to realize where your drivers and estimates may be inaccurate. Being self-aware of your market sizing shortcomings will place more emphasis on your problem-solving abilities (a must-have in consulting) and less emphasis on the accuracy of your answer (bonus points if you actually nail it!).

Casing is sometimes more about not being too wrong than it is about being exactly right.

Where Can I Start?

I hope you found these tips helpful as you prepare and interview for a management consulting role. Here are a few other articles to help you solidify your application even more.

- An Expert’s Guide to Resumes: Five Tips to Make You Stand Out

- A Day in the Life of a Management Consultant

- Five Tips for Breaking Into Management Consulting

- A Comprehensive Guide to the Consulting Case Interview – With Examples

- Top 3 Tactics to Ace Your Case Interview

If you’d prefer to work with a coach for one-on-one guidance and personalized advice, view my profile here and book a free intro call to get started! I’d love to help you at any point in your consulting application process.

Written by Wesley

5.0

(27)

Hi! I'm Wesley B. I learned about a career in Management Consulting 9 months before the intern recruiting season. I met with a coach/mentor (Consultant at Bain & Company), and he helped co-create a personalized plan for me. The plan was a critical backbone for my preparation and pushed me through all the barriers that came my way. The overall recruiting experience was challenging (and stressful!), but I gained appreciation for the coach I had by my side. The plan, which included retaking the ACT (a story for another day), landing a preparatory internship, networking, case prepping, etc. helped me submit my application to 6 consulting firms, earn first-round interviews from 4 firms (all three MBB firms), and land final round interviews from 2 MBB firms. Since joining Bain as an intern in 2019, I've mentored dozens of individuals through the recruiting process (from learning about the firms to nailing the final interview) and helped them land jobs at Bain, McKinsey, BCG, and other consulting firms. I always tell people that the skills learned from preparing for a career in consulting are agile and will help you in every career you pursue! I am originally from Provo, Utah. I played baseball at BYU and am the happy father to two children (4-year-old son and 2-year-old daughter). My wife and I currently live in Evanston, Illinois as I earn my MBA from Kellogg School of Management. I am excited to share with you the exact things that helped me get an offer!

Wesley has helped clients get into organizations like:

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.